Ukraine

Membership

Membership

-

Overall implementation performance

Overall implementation performance 2023

CLUSTER INDICATORS 2023 HIGHLIGHTS AND NEXT STEPS .2023-12-08-13-48-12.png)

Markets and integration The Law on REMIT was adopted in June 2023 and its implementation started. Ukraine certified its gas storage operator. Ukraine should accelerate transposition and implementation of the Electricity Integration Package as a precondition for the coupling of its short-term markets. Ukraine should re-establish the gas market fundamentals and further strengthen the unbundling status of GTSOU.

Decarbonising the energy sector Ukraine adopted a law which provides the legal framework for implementing a guarantees of origin registry, introduces a net billing scheme for self-consumption and provides directions for future renewable energy auctions. Ukraine should submit the draft NECP to the Secretariat. Ensuring energy security The operation of the electricity system was preserved despite severe energy infrastructure damages caused by the Russian military aggression. Ukraine fulfilled the gas storage targets. Ukraine should improve the risk-preparedness planning starting with the transposition of the Regulation (EU) 2019/941 on Risk-preparedness in the Electricity Sector and the designation of a competent authority. Ukraine should adopt a risk assessment for the gas market and transpose the Security of Gas Supply Regulation. Improving the environment In Ukraine, implementation of the environmental acquis is overshadowed by the ongoing military aggression. Nevertheless, compliance is still high. Performance of authorities The regulator certified the gas storage system operator in line with the Energy Community gas regulation and adopted a set of secondary legislation acts enabling REMIT implementation. NEURC should adopt the remaining REMIT legislation and launch the relevant investigatory and enforcement actions. status: November 2023

source: compiled by the Energy Community Secretariat -

Dispute settlement cases

Dispute settlement cases

By end of the reporting period, Ukraine had two dispute settlement cases.

Procedures under Article 91 EnCT where the procedure has been closed with the adoption of a Ministerial Council decision, but the breach has not been rectified yet. ECS-1/18 Energy efficiency ECS-4/18 Infrastructure status: November 2023source: compiled by the Energy Community Secretariat

-

Implementation by market indicators

Implementation by electricity market indicators

Implementation by gas market indicators

* due to lack of gas market, the average excludes Kosovo* and Montenegro. The gas performance values are calculated on the basis of seven Contracting Partiesstatus: November 2023

source: compiled by the Energy Community Secretariat

Implementation by security of supply indicators

November 2023

source: compiled by the Energy Community Secretariat

Decarbonising the energy sector

-

Implementation by decarbonisation indicators

Implementation by governance indicators

Implementation by renewable energy indicators

Implementation by energy efficiency indicators

November 2023

source: compiled by the Energy Community Secretariat

-

2030 renewable energy targets and capacities

Targets for share of energy from renewable sources

Contracting Party 2005 Share of energy from renewable sources 2020 Target for share of energy from renewable sources 2030 Target for share of energy from renewable sources Ukraine 5,5% 11% 27,0% source: Decision 2022/02/MC-EnC on incorporating Clean Energy Package into Energy Community acquis

2021 Total capacities of renewable energy (MW)

status: November 2023

source: Ministry of Infrastructure and Energy

-

2030 energy efficiency targets, energy consumption and trends

2030 Primary and Final Energy Consumption (PEC) Targets

Contracting Party 2020 primary energy consumption (PEC) 2020 final energy consumption

(FEC)2030 primary energy consumption (PEC) 2030 final energy consumption

(FEC)Ukraine 82,80 Mtoe 46,78 Mtoe 91,47 Mtoe 50,45 Mtoe source: Decision 2022/02/MC-EnC on incorporating Clean Energy Package into Energy Community acquis

2021 Primary Energy Consumption (PEC) and Trends

2021 Final Energy Consumption (FEC) and Trends

Energy intensity, 2021 value and trends: 0,88 ktoe/mil EUR, ↑ +1,0%

status: November 2023

source: EUROSTAT 2023 data, NECP and 2022 Ministerial Council Decision

-

Implementation by environment indicators

Implementation by environment indicators

November 2023

source: compiled by the Energy Community Secretariat

-

LCPD implementation

Installations Under the Large Combustion Plants Directive

Type of plants Number on plants

of plants falling under the LCPD 248

of which opted out plants 19+59*

of which plants falling under the NERP 90 *Under Decision 2015/07/MC-EnC, certain plants in Ukraine are entitled to use 40.000 hours for opted out plants. 59 plants fall into that category.

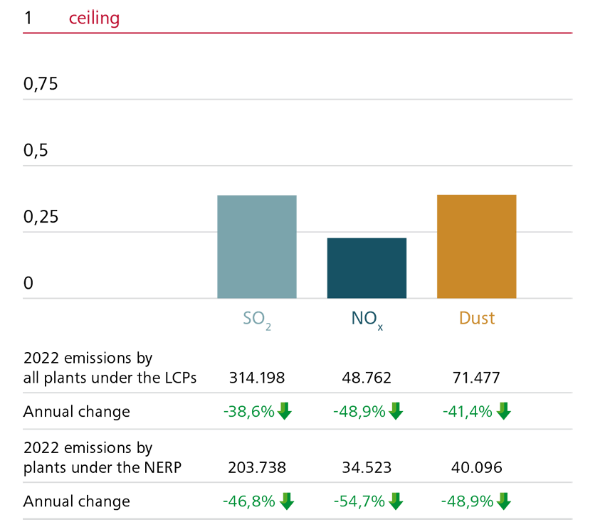

source: compiled by the Energy Community Secretariat2022 emissions versus NERP ceilings

source: compiled by the Energy Community Secretariat

Amount of operational hours used from opt-out period*

Plant Expected expiry of opt-out period Remaining hours Operating hours consumed in 2018 - 2022 Average of plants under

Decision 2013/05/MC-EnC**December 2023 9.986

10.014 Average of plants under

Decision 2015/07/MC-EnC4***December 2023 29.169

10.830 * Due to the large number of plants under the opt-out regime in Ukraine, an average for both opt-out regimes is being provided. The expected expiry of the optout is also provided based on this average. It varies on a plant-by-plant basis.

** Under the regime of Decision 2013/05/MC-EnC, opted-out plants can remain in operation for a total of 20.000 operational hours until 31 December 2023.

*** Under the regime of Decision 2015/07/MC-EnC, which amended Decision 2013/05/MC-EnC to reflect the special situation of Ukraine, certain opted-out plants can remain in operation for a total of 40.000 operational hours until 31 December 2033. The list of plants was adopted by Decision 2016/19/MC-EnC.

source: compiled by the Energy Community Secretariat -