Moldova

Membership

Membership

-

Overall implementation performance

Overall implementation performance 2023

CLUSTER INDICATORS 2023 HIGHLIGHTS AND NEXT STEPS .2023-12-08-13-48-12.png)

Markets and integration The transmission system operator Moldelectrica was certified on 11 July 2023 as an independent system operator. ANRE provisionally designated Vestmoldtransgaz as a natural gas transmission operator of the Moldovatransgaz network, the basis for the unbundling of the country’s gas infrastructure operators. Moldova should accelerate the transposition and implementation of the Electricity Integration Package, prioritizing short-term electricity markets and their integration. The certification of Vestmoldtransgaz should be finalized, followed by the removal of barriers to create a genuine free gas market.

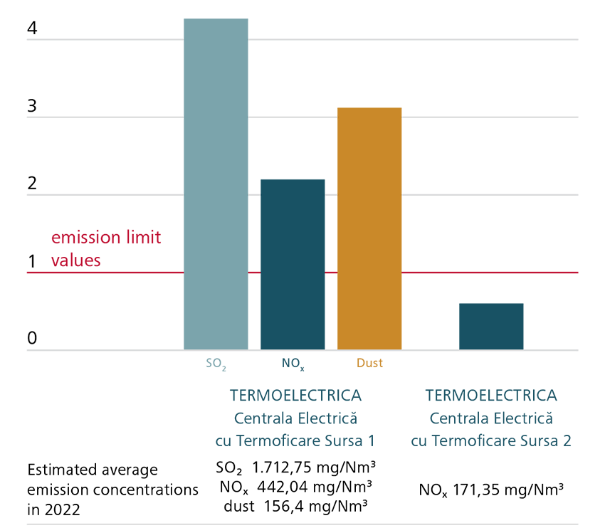

Decarbonising the energy sector Moldova keeps expanding its renewable energy capacities through a self-consumption scheme. It has made significant progress with the Clean Energy Package alignment by adopting the Energy Efficiency Law. To have the final version adopted within the deadlines set by the Governance Regulation, Moldova should submit the draft NECP to the Secretariat. Ensuring energy security The emergency state is in force until 30 November 2023. The electricity supply contract with MGRES was extended until the end of 2024. The Law on Cybersecurity was approved in 2023. Moldova is independent of Russian gas supplies. It achieved the gas storage targets without formally implementing them. As a matter of priority within the regional context, the Government should transpose Regulation (EU) 2019/941 on Risk-preparedness in the Electricity Sector and update its sectoral risk-preparedness plan. Moldova needs to speed up the transposition of the Security of Gas Supply Regulation. Improving the environment Due to fuel supply switches, the good compliance record of Moldova with emission regulations was broken. Compliance should be re-established without delay. Performance of authorities ANRE exercised its competences regarding the unbundling of the gas transmission system operator and withdrew the license of Moldovatransgaz. Competences on REMIT in the electricity sector should be established. status: November 2023

source: compiled by the Energy Community Secretariat -

Dispute settlement cases

Dispute settlement cases

By end of the reporting period, Moldova had two dispute settlement cases.

Procedures under Article 91 Energy CommunityTreaty where the procedure has been closed with the adoption of a Ministerial Council decision, but the breach has not been rectified yet. ECS-7/18 Environment ECS-24/21 Environment status: November 2023

source: compiled by the Energy Community SecretariatSecurity of supply

Implementation indicators

-

Primary fuel mix and available energy

2021 Fuel mix in primary production of energy (in ktoe)

status: November 2023

source: EUROSTAT

2021 Gross available energy per product (in ktoe)

status: November 2023

source: EUROSTAT

-

Primary supply of electricity

Fuel mix and primary supply of electricity

status: November 2023

source: Ministry of Economy, compiled by the Energy Community Secretariat

-

Implementation by market indicators

Implementation by electricity market indicators

Implementation by gas market indicators

* due to lack of gas market, the average excludes Kosovo* and Montenegro. The gas performance values are calculated on the basis of seven Contracting Parties.

status: November 2023

source: compiled by the Energy Community Secretariat

-

Average annual prices

Average annual prices of electricity for end users per component

Average annual prices of gas for end users per component

Implementation by security of supply indicators

status: November 2023

source: compiled by the Energy Community Secretariat

Decarbonising the energy sector

-

Implementation by decarbonisation indicators

Implementation by governance indicators

Implementation by renewable energy indicators

Implementation by energy efficiency indicators

November 2023

source: compiled by the Energy Community Secretariat

-

2030 renewable energy targets and capacities

Targets for share of energy from renewable sources

Contracting Party 2005 Share of energy from renewable sources 2020 Target for share of energy from renewable sources 2030 Target for share of energy from renewable sources Moldova 11,9% 17,0% 27,0% source: Decision 2022/02/MC-EnC on incorporating Clean Energy Package into Energy Community acquis

2022 Total capacities of renewable energy (MW)

status: November 2023

source: Ministry of Economy

-

2030 energy efficiency targets, energy consumption and trends

2030 Primary and Final Energy Consumption Targets

Contracting Party 2020 primary energy consumption (PEC) 2020 final energy consumption

(FEC)2030 primary energy consumption (PEC) 2030 final energy consumption

(FEC)Kosovo* 2,69 Mtoe 2,55 Mtoe 3,00 Mtoe 2,80 Mtoe source: Decision 2022/02/MC-EnC on incorporating Clean Energy Package into Energy Community acquis

2021 Primary Energy Consumption (PEC) and Trends

2021 Final Energy Consumption (FEC) and Trends

Energy intensity, 2021 value and trends: 0,39 ktoe/mil EUR, ↓ -2,7%

status: November 2023

source: EUROSTAT 2023 data, NECP and 2022 Ministerial Council Decision

-

Implementation by environment indicators

Implementation by environment indicators

status: November 2023

source: compiled by the Energy Community Secretariat

-

LCPD implementation

Installations Under the Large Combustion Plants Directive

Type of plants Number on plants

of plants falling under the LCPD 2

of which opted out plants 0

of which plants falling under the NERP 0 source: compiled by the Energy Community Secretariat

2022 emissions versus NERP ceilings

source: compiled by the Energy Community Secretariat

-